To assess the rental investment potential of any project, investors should base their analysis on actual market data and key factors as follows:

1. Selling Price from the Developer

Developers usually set the primary sales price based on:

- Total development costs (including legal procedures, construction materials, labor, etc.)

- Pricing of comparable projects in the area (based on developer reputation, project quality, facilities, etc.)

- Their expectations for future on-site amenities, surrounding public infrastructure, and connectivity.

Based on this, buy-to-let investors will determine their target rental price and expected yield from their purchase price.

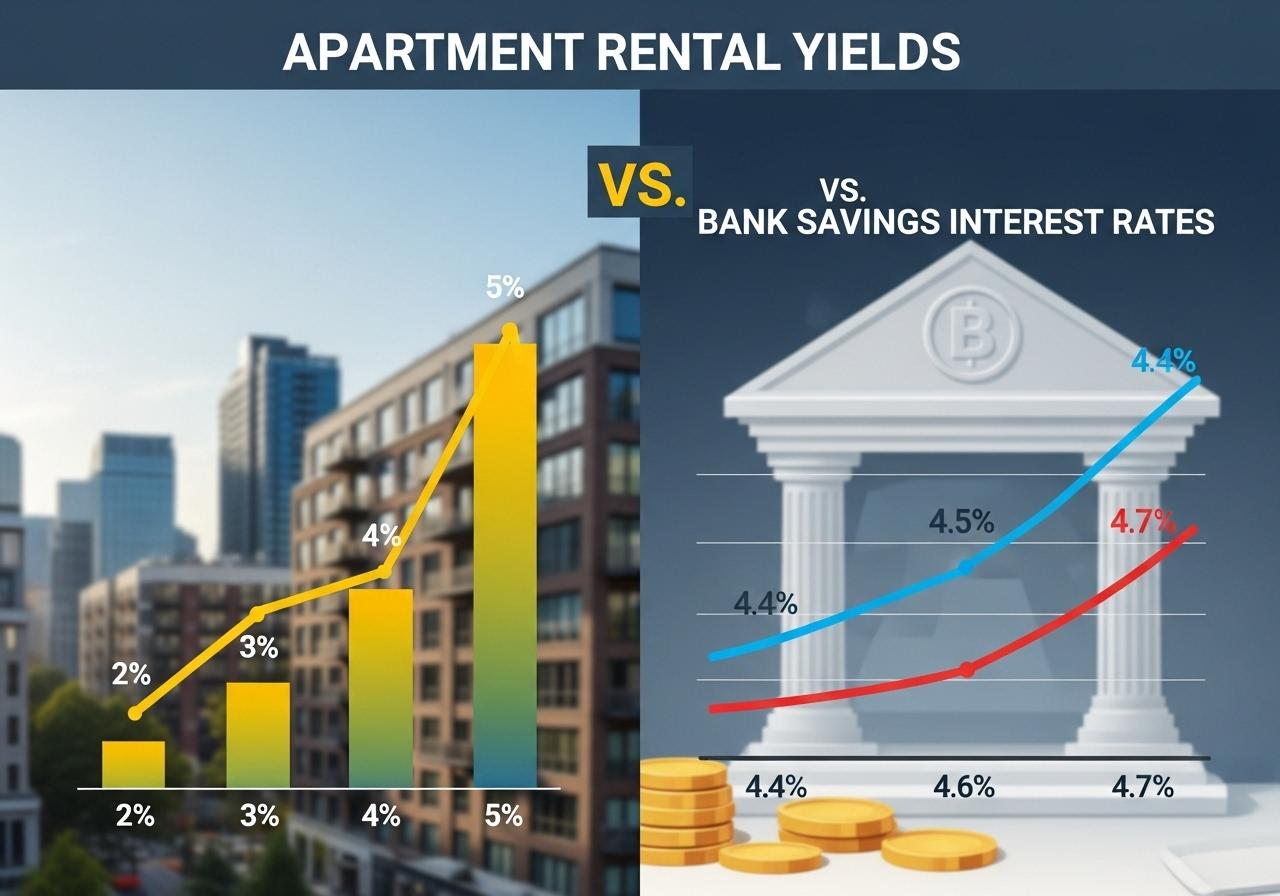

The ideal scenario is for the yield to exceed the 12-month savings interest rate at local banks. This allows investors to benefit from compound returns — rental income + property value appreciation over time.

- Current average 12-month savings interest rate in Vietnam: 4.6% – 4.7% per year (for Vietnamese).

- For foreign non-resident investors: 0% interest on local savings.

For foreign investors, a rental yield of 3–4% is already considered attractive, especially given Vietnam’s long-term growth potential.

2. Reference from Online Real Estate Listings

Investors can research rental prices of comparable projects in the same area through major listing platforms such as:

- batdongsan.com.vn

- chotot.com

- nhatot.com

3. Average Rental Yield & Market Trend in HCMC / Vietnam

- According to Global Property Guide, current rental yields in Ho Chi Minh City are around 3–5%, depending on location and unit type.

- Recent trend: Apartment selling prices have been increasing faster than rental prices, causing rental yields to gradually decline. However, rising property prices are expected due to stricter development regulations, while rental prices and yields will adjust over time.

The real estate market in Vietnam is also recovering after a slowdown, with both primary and secondary prices trending upward.

4. Assumptions on Market Operations

- Vacancy rate: Typically assumed low (2–10%) for new projects with strong amenities and good rental demand.

- Newly handed-over projects often see lower initial rents in Year 1 due to high unit supply, but rental prices and occupancy rates usually improve from Year 2 onwards as operations stabilize and the community forms.

- Transportation infrastructure: Usually completed or nearing completion upon project handover, significantly influencing tenants’ decision to rent

Additional Assumptions for Estimation

- Interior & view: Well-furnished units with good views and higher floors achieve higher rental prices than the average assumption.

- Unit size: Smaller units typically have a higher rental yield percentage, as the total purchase price is lower and fixed costs are more efficient.

- Connectivity, amenities & branding: Well-developed internal and external facilities and reputable developers positively influence achievable rent.

- Macroeconomic factors: Inflation, financial market trends, and expected rent growth support periodic rent increases or at least price stability.

For references to projects with the best rental prices and yields, please contact:

📩 Email: helen.nguyen@era.com.vn

📞 Phone: 0906 74 1539 (WhatsApp, Line, Zalo, WeChat, KakaoTalk)

🏢 ERA Vietnam — Sala Urban Area, Thu Thiem, No. 22–24, Street No. 5, An Loi Dong Ward, Thu Duc City, Ho Chi Minh City, Vietnam.